Find the latest CASINO GUICHARD (CO.PA) stock quote, history, news and other vital information to help you with your stock trading and investing. 1 53 65 64 17 lbenchimol@groupe-casino.fr or+. Find the latest CASINO GUICHARD PERRACHON SA CA (0HB1.IL) stock quote, history, news and other vital information to help you with your stock trading and investing.

- View Groupe Casino (www.groupe-casino.fr) location in Auvergne-Rhone-Alpes, France, revenue, industry and description. Find related and similar companies as well as employees by title and much more.

- Casino Group reported first-half results up 9.4% and 8.4% on an organic and same-store basis, respectively. French like-for-like sales growth was 6% with hypermarkets down 0.8%, Monoprix up 2.9%.

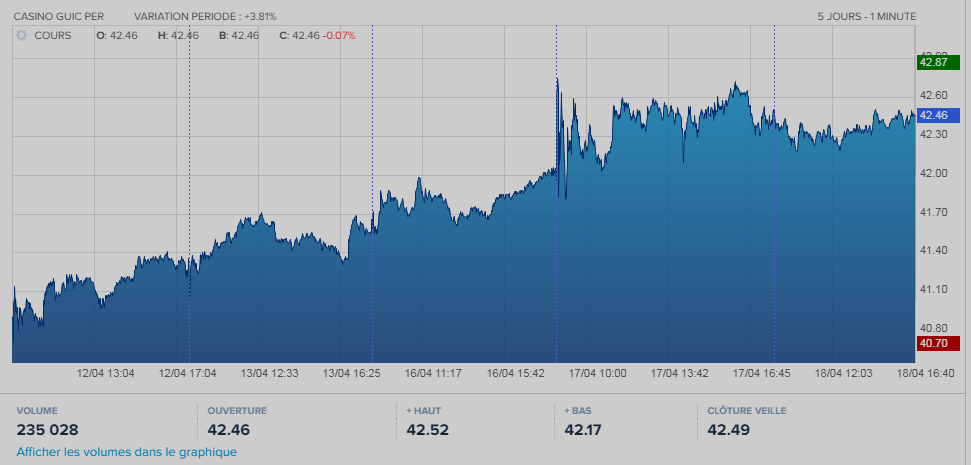

Groupe Casino Stock Price

Morningstar Quantitative ratings for equities (denoted on this page by) are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. Companies withratings are not formally covered by a Morningstar analyst, but are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating. Click here for more on how to use these ratings.

Groupe Casino Stock Exchange

Groupe Casino Stock Symbol

No-moat Casino Group reported third-quarter net sales up 6.2% on a same-store basis with French like-for-like sales growth slightly down at 0.2% with hypermarkets down 3%, Monoprix down 1.2%, supermarkets slightly up 0.8% and convenience stores up 6.5%. This compares with 3.8%, 2.5%, 4.9% and 5.3% like-for-like sales growth increases for Carrefour in France, hypermarkets, supermarkets and convenience stores respectively in the same quarter, a broad underperformance for Casino Group. In Latin America like-for-like sales growth was 11.6% higher, with Brazil sales advancing by 20% versus 26% for Carrefour Brazil. Casino said the EBITDA improvement in the quarter was EUR 46 million, a result of tight cost controls (including costs associated with the coronavirus), which we think might have weighed on top-line growth. Although the EBITDA margin improvement was a positive surprise, we were disappointed with the group's relative top-line performance in France, which implies significant market share losses. More importantly, on cash flow generation, the group also stated gross debt is expected to decrease by EUR 1 billion to EUR 5 billion by the end of 2020 in France, primarily a result of the Leader Price sale (about EUR 700 million proceeds) and positive cash flow in France (implying very limited expected cash flow generation in the second half, given about EUR 250 million of cash flow generated in the first half). We reduce our fair value estimate for Casino Group to EUR 26 from EUR 30.5 to reflect more significant currency headwinds in Brazil and lower top-line growth/cash flow generation in France as we update our model to account for this quarter's numbers.